Hedge Fund

Market

2016 started off with renewed worries about the economic development in China, which lead to a very negative sentiment in markets. Equities, oil and interest rates fell significantly until mid-February, when sentiment turned on the back of rumors of an agreement between Saudi Arabia and Russia to freeze oil production. Investors piled into energy- and commodity related equities, and there was a strong rotation away from stocks which had performed well in 2015 into stocks that had sold down.

The Fed was also influenced by the negative sentiment, and were opportunistic in their arguments for postponing interest rate hikes. Macroeconomic data were mostly good throughout the year, and except for the volatility exhibited at the start of the year and post the UK Brexit vote, volatility in markets mostly remained low.

Equity markets experienced strong rotations on both sector and factor levels at the start of the year and through Brexit. The initial reaction to the unexpected election result was significant; The British pound fell 11% on the election day and weakened 17% throughout the remainder of the year. The UK equity market on the other hand recovered quickly and rose 13% in local currency from Brexit to year end. Dispersion however was high, and whereas export oriented and defensive stocks rose after Brexit, domestic oriented and cyclical stocks fell. European banking stocks fell sharply following Brexit, but as interest rate expectations changed in the fall, the market turned more positive on the sector, and European banks rose 49% from trough until year end.

Strong macro views, top-down allocations and an increased flow from passive investment products lead to a tough year for many fundamental stock pickers. Market sentiment improved during the second half of the year, particularly after the US election. US equities, and the financial sector and cyclical stocks in particular, had a very strong end to the year. The 5-year treasury yield rose 25 bps in 2016, a very modest move considering the FED hike of 25 bps in December and macroeconomic indicators which signal improving economic conditions.

In aggregate, 2016 was a good year for risky assets, and for investors who sat through the volatile periods. The oil price rose sharply, and credit markets and energy stocks followed suit. The Oslo Stock Exchange rose 14,6%, MSCI World 7,5% in USD and 9% in local currency.

Results

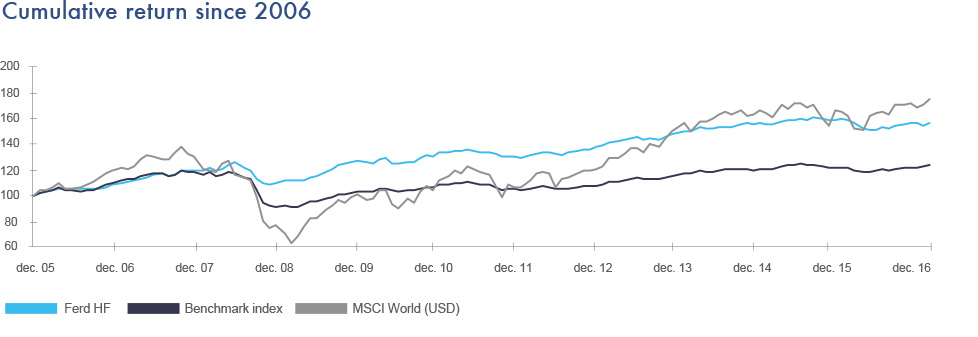

The hedge fund portfolio returned -1,5% (USD) in 2016 compared to the benchmark index which rose 1,9%. The hedge fund portfolio is currency hedged to Norwegian Kroner internally against our treasury department, and the portfolio result in Norwegian kroner was -48 million. The market value of the portfolio as at the end of 2016 was 3,42 billion NOK.

It was a challenging year for several of our equity related fund investments, and these funds had the common denominator of strong performance in 2015.

The hedge fund portfolio's three macro mangers were up close to 9% in 2016, primarily driven by positioning within Brazil and Venezuela. Positioning in US interest rates also contributed positively in the second half of the year.

The relative value funds had the weakest return in 2016. The weighted return of -4% was driven by three funds which were badly hit by the factor- and sector rotations we observed in equity markets. The two largest holdings among these funds, two multi-strategy funds, performed in line with peers.

Our three equity L/S managers returned -3,9%. For two of these mangers, it was the long book that underperformed the market. We did not make any changes to our equity L/S exposure in 2016.

Portfolio concentration was increased further in 2016. We invested 72 MUSD and initiated two new investments while we redeemed from five funds. As at year end, the top five and ten investments constituted 43% and 71% of the portfolio.

Global Fund Opportunities

We have experienced a steady flow and spent considerable time evaluating investment proposals for Global Fund Opportunities in 2016. As in 2015, a majority of the cases have involved investments in less liquid markets and instruments with a distressed angle. We did not make any new investments in 2016.

The two existing investments returned -0,6% in 2016. Positive contribution from mark ups in a few unlisted positions was offset by negative performance in liquid equities. While the pace of investments slowed in 2016 relative to 2015, the mangers are seeing good diversity and are satisfied with the quality of the deal flow. The progress in existing investments is satisfactory, and as most investments are in illiquid assets, most of the value creation is expected to be materialized as specific transactions or exists take place.

Organization

Entering 2017, we have made changes to the mandate structure in the business area. Going forward, Ferd's investments with external managers will be managed through four different mandates. The hedge fund portfolio will be split into three, while the Global Fund Opportunities mandate will continue in its existing form. The four mandates have different return and risk profiles:

- Relative value: concentrated portfolio of hedge funds with low market sensitivity

- Global macro: concentrated portfolio of hedge funds with variable market sensitivity and higher return and risk expectations than relative value

- Global equity: equity longs/short and actively managed long-only equity funds which complement the firm´s direct investments

- Global Fund Opportunities: investments in specific market opportunities with variable liquidity profiles and higher return and risk expectations.

- We believe the new structure will lead to an improved discussion concerning capital allocation and allocation of risk to the business area than what can be achieved through a single, broad hedge fund portfolio.

The investment team consists of two people, and there have been no changes during 2016.

Outlook

We expect to see continued improvement in macroeconomic data and higher inflation pressure, which will put pressure on assets with low nominal yields. This in turn can potentially lead to larger portfolio adjustments among investors and more volatility in markets. The large flow into passive investment products in recent years and increased banking regulation means there is less available active capital to arbitrage this volatility, which should create ample opportunities for the managers we´re invested with.