Invest

Markets

In 2016 stock markets broke with the trend seen in recent years for investors to focus on quality and growth. Following the falls in February, we gradually saw investors rotate into cyclical industries in particular, and there were significant returns to be made from exploiting this theme. The trend for small companies to outperform large companies that started in 2015 strengthened in 2016, particularly in Sweden and Finland.

Return

The market value of Ferd Invest’s portfolio increased by 0.6% in 2016, which is 2.7 percentage points less than our benchmark index. Ferd Invest’s best investments in 2016 were Stora Enso, Skandiabanken and Marine Harvest. The only investment to constitute a significant drag on performance was Novo Nordisk which, after having delivered good returns for the portfolio for a long period, fell sharply due to even greater downward pressure on prices for the company’s products in the USA in 2016. Novo Nordisk reduced the portfolio’s return by 4 percentage points in 2016. At Opera Software, we accepted an offer of NOK 71 per share for the whole company in February 2016, and this would have led to a significant positive return for 2016. The transaction was, however, not approved by the required authorities in time, with the share price therefore falling back to the level it was at before the offer was made.

As an overall summary, we are satisfied with the fact that we again had few poor investments in 2016. At the same time, too few of our investments made a significant positive contribution, and having an investment as significant as Novo Nordisk fall in value as much as it did does not allow us to be entirely satisfied with the portfolio’s performance in 2016.

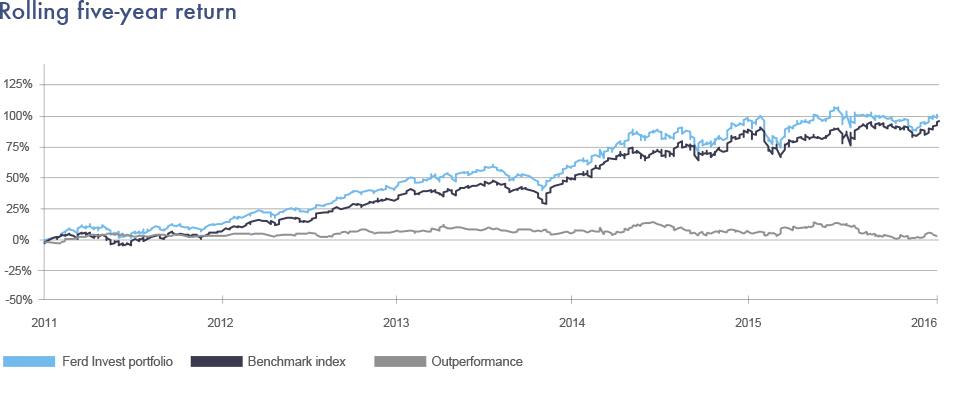

Ferd Invest’s long-term performance continues to measure up well. Over the last five years, the portfolio has achieved a return of 151%, during which time our benchmark index, the MSCI Nordic Mid Cap Index, has risen 143%.

Portfolio

The market value of Ferd Invest’s portfolio at the close of 2016 was NOK 5.3 billion. The portfolio’s investments are divided between the three Scandinavian stock markets, as well as the Finnish stock market. The largest investments at the close of 2016 were Autoliv, HM, Norwegian and Stora Enso.

Organisation

The Ferd Invest team currently has three members. Samson Sørtveit resigned in June 2016, while Nicolay Mylèn joined the team in January 2017. Are Dragesund and Lars Christian Tvedt are the other two members of the Ferd Invest team.

Future Prospects

We have seen a marked change in investor sentiment in the final part of 2016 and the period up to the present in 2017, with investors now much more positive about the world economy’s future prospects. The growth in stock markets in the period up to and including 2015 was influenced by interest rates steadily decreasing and investors consequently having lower return requirements, with this causing the premium for stable earnings growth (i.e. “quality”) to go up and up. Following a turbulent start to 2016, markets have risen on expectations of a cyclical upswing and accordingly higher inflation and higher interest rates. Although we are now seeing signs that the global economy is improving, this has already to a large extent been priced in by rising stock markets. Investors have become willing to take more risk, a trend which may continue and so cause share prices to continue to rise. However, it is uncertain how long this will last, and it is in this phase of the market cycle that the chance of incurring significant losses increases the most. Ferd Invest will therefore be wary of increasing the portfolio’s risk profile despite the markets continuing to rise.