Board of Director's Report

2016 was a good year for Ferd, with the group delivering a return of NOK 2.5 billion equivalent to 9%. This return was higher than that delivered by Nordic stock markets, but a little lower than that delivered by the Oslo stock exchange. There was a lot of variation in the results reported by Ferd’s various business areas. Ferd Capital’s portfolio of unlisted companies performed very strongly, and the real estate portfolio delivered a return of 35%. The stronger results achieved by the portfolio companies Mestergruppen and Elopak, the latter of which is Ferd’s largest investment, were the principal reason for Ferd Capital achieving a return of 18%.

2016 was a good year for Ferd, with the group delivering a return of NOK 2.5 billion equivalent to 9%.

The return on Ferd’s portfolio of investments in Nordic listed companies was virtually flat, while the hedge fund portfolio made a slight loss. Approximately 60% of Ferd’s investments are denominated in Norwegian krone, 15% in US dollar, and just under 20% in euro. The Norwegian krone strengthened against these two currencies in 2016, with Ferd recording a foreign exchange loss of just under NOK 0.5 billion.

Ferd Capital’s portfolio of unlisted companies performed very strongly, and the real estate portfolio delivered a return of 35%.

Over NOK 2.2 billion was invested in 2016 through Ferd Capital’s mandates, with the business area investing in both listed and unlisted companies. Nearly NOK 500 million was invested in Aibel. Mestergruppen acquired two member-owned chains. In November 2016, Petroleum Geo-Services (PGS) completed a share issue totalling USD 225 million, with Ferd contributing NOK 262 million of this amount. Approximately NOK 450 million was allocated to Ferd Real Estate, where the largest investment made was in a commercial property in Forus outside Stavanger.

Over NOK 2.2 billion was invested in 2016 through Ferd Capital’s mandates, with the business area investing in both listed and unlisted companies.

Ferd Social Entrepreneurs took its first equity stake in a company in 2016, namely in Unicus. Unicus employs people with Asperger’s syndrome, who principally work on testing IT solutions. Ferd made a number of significant disposals in 2016, the largest of which was TeleComputing. Nearly NOK 500 million was received in 2016 from investments in private equity funds and hedge fund units purchased in the secondary market. At the close of 2016, the parent company had available a credit facility of NOK 6 billion. Going forward Ferd has considerable capital resources available for new investments.

Ferd Social Entrepreneurs took its first equity stake in a company in 2016, namely in Unicus.

In March 2017, the Board of Directors approved the appointment of Morten Borge as the new CEO of Ferd, and he will take up the position in August of this year. Morten has worked at Ferd for nine years and has been Co-Head and Investment Director of Ferd Capital since autumn 2012.

Market environment

There were large fluctuations in the financial markets in 2016, but over the year as a whole equities and real estate delivered good returns. The first quarter was characterised by the fall in the price of oil, while in the second half of the year stock markets rose despite the UK voting to leave the EU and Donald Trump winning the presidential election in the USA. The world index for equities eventually ended the year up 9% in local currency terms.

In the oil industry, there was less activity and lower profitability for providers of goods and services to the sector. Oil investment was approximately 15% lower in 2016 than in 2015. The other sectors of the Norwegian economy performed significantly better, and Norway recorded overall growth of 0.7% in 2016. Norges Bank lowered its key policy rate to 0.5% in March 2016, where it remained for the rest of the year. Since Norway is now in a position where a weak currency has to be seen as a positive factor, the market expects Norges Bank to keep interest rates low for the next few years. The residential real estate market and centrally located commercial properties were up strongly in 2016, with residential prices in Oslo climbing 23%.

Future prospects

The world economy will probably grow more quickly in 2017 than in 2016. Emerging economies are growing the most strongly, but there are also clear signs of improvement in the USA and Europe. Unemployment is on its way down in most industrialised countries, and inflation seems to be rising. The outlook for Norway’s economy is similar, with slightly higher growth expected in 2017. However, there continue to be significant risk factors going forward, for example a possible trade war between the USA and China, and generally an increased risk of protectionism.

When making investment decisions, Ferd attaches little weight to the overall macroeconomic outlook. Factors specific to each investment opportunity play the crucial role when deciding whether or not an investment is an attractive proposition.

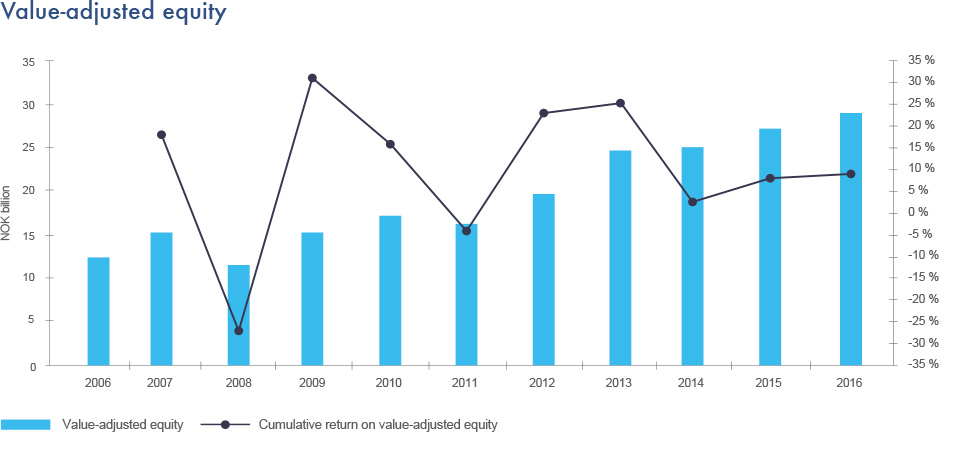

The group’s value-adjusted equity

At the close of 2016, Ferd’s value-adjusted equity was NOK 28.8 billion. Ferd holds a diversified portfolio of listed and unlisted equity investments, alternative investments, and real estate. Ferd’s equity investments provide good diversification between sectors and geographical markets and between companies at different stages of the corporate lifecycle. Ferd Capital’s portfolio represented approximately 45% of Ferd’s value-adjusted equity at the close of 2016.

Over the last ten years, Ferd has generated a total return of NOK 17.2 billion, equivalent to an annual return of 8.8%. It is important for the returns achieved by Ferd to be assessed in the context of the absolute return achieved over time and how this relates to the level of risk exposure that has been involved.

Over the last ten years, Ferd has generated a total return of NOK 17.2 billion, equivalent to an annual return of 8.8%.

Financial results for Ferd AS

Ferd AS reports an accounting profit for the year of NOK 2,374 million, an increase of NOK 551 million from 2015. The better results achieved by Ferd’s unlisted portfolio companies were the most important reason for this improvement.

For further commentary on Ferd’s financial results in 2016, the reader is referred to the separate sections on each business area on the following pages.

Net cash flow for 2016 was made up of NOK 24 million from operating activities and NOK 910 million from investment activities. After the sale of TeleComputing, dividends received from subsidiary companies were the most important source of cash flow from investment activities. Cash flow from financing activities was NOK -454 million.

The annual accounts have been prepared on the going concern assumption and, in accordance with Section 3-3a of the Accounting Act, the Board confirms that the going concern assumption is appropriate.

The registered office of Ferd AS is in Lysaker in Bærum municipality.

Financial results and cash flow for Ferd (Ferd AS group)

Operating revenue from continuing operations was NOK 15.0 billion in 2016 as compared to NOK 15.2 billion in 2015. Sales revenue increased from NOK 12.9 billion in 2015 to NOK 14.2 billion in 2016. Mestergruppen’s revenue was NOK 0.9 billion higher in 2016 than in 2015, principally due to its acquisition of Byggtorget and Nordek. Elopak reported operating revenue for 2016 of NOK 8.2 billion, an increase of NOK 0.7 billion from 2015, which was principally due to higher revenue thanks to increased sales of roll-fed aseptic cartons.

The group’s development activities are primarily conducted at its subsidiaries. Development costs of NOK 36 million were expensed in 2016.

The group’s financial items showed a net financial gain of NOK 37 million as compared to a net financial expense of NOK 681 million in 2015. This change was principally due to foreign exchange effects.

Ferd normally has a low effective tax rate because a large part of its earnings is generated from investments in shares. Under the exemption model, gains on shares are not taxable. The group’s tax charge for 2016 was NOK 211 million as compared to a charge of NOK 318 million in 2015. The principal reason for the decrease is the reduction in deferred tax on Ferd’s fund investments.

Net cash flow for 2016 was made up of NOK -356 million from operating activities, NOK -451 million from investment activities, and NOK 674 million from financing activities.

Strategy

The overall vision for Ferd’s activities is to “create enduring value and leave clear footprints”. Ferd’s corporate mission statement is that the group is “committed to value-creating ownership of businesses and investment in financial assets in situations that enable us to make good use of our expertise and the competitive advantages that result from our family ownership”. Ferd will accordingly strive to maximise its value-adjusted equity capital over time.

It is Ferd’s intention that its allocation of capital should be characterised by a high equity exposure and good risk diversification. Ferd’s equity investments represent a well-diversified portfolio. Ferd’s hedge fund investments help to reduce and diversify the group’s overall risk exposure.

The Board keeps Ferd’s risk capacity under continuous review. The allocation of new capital, as well as the reallocation of capital between business areas, represents a systematic approach to making use of the group’s capital base. Capital allocation must be consistent with the owner’s willingness and ability to assume risk. This provides guidance on how large a proportion of equity can be invested in asset classes with a high risk of fall in value. The risk of fall in value is measured and monitored continually with the help of stress testing.

Ferd aims to maintain sound creditworthiness at all times in order to ensure that it has freedom of manoeuvre and can readily access low-cost financing at short notice when it wishes. In order to protect Ferd’s other equity from risk, Ferd Capital and Ferd Real Estate carry out their investments as stand-alone projects. Maintaining good liquidity is important to ensuring Ferd has the freedom to manoeuvre as it wishes. Ferd has always held liquidity comfortably in excess of the minimum liquidity requirements we impose internally and the requirements to which we are committed by loan agreements at the parent company level. Ferd has an active approach to currency exposure. We work on the assumption that a certain proportion of Ferd’s equity will always be invested in euro, US dollar and Swedish krona denominated investments, and accordingly do not normally hedge currency exposure against the Norwegian krone.

Further information on Ferd’s strategy can be found here.

Corporate governance

Ferd is a relatively large corporate group, with one controlling owner family. Despite this, the Board of Directors of Ferd Holding AS has substantially the same responsibilities and authority as the board of a public company.

Not all the sections of the Norwegian Code of Practice for Corporate Governance are relevant to a family-owned company, but Ferd complies with the Code insofar as it is relevant and appropriate. Further information is provided in the Corpoate Governance section. The Board of Directors of Ferd Holding held eight Board meetings in 2016.

Ferd Capital

Ferd Capital took stakes in the stock exchange listed companies Scatec Solar and Benchmark Holdings in 2016, and increased its ownership interest in Petroleum Geo-Services (PGS). Ferd Capital’s largest listed investments are:

- PGS, which is a leading global player in the seismic industry. The company offers a broad spectrum of products, including both seismic and electromagnetic services, data acquisition and processing, reservoir analysis and interpretation, and multi-client library data.

- Scatec Solar, which is a Norwegian company that develops, builds, owns and operates solar power plants.

- Benchmark Holdings, which helps improve fish health and sustainability in the fish farming industry by selling specialist foods, breeding and genetics products, and medications.

Ferd Capital seeks to actively contribute to the development of the stock exchange listed companies in which it has invested. Ferd Capital made six investments through its Special Investments mandate in 2016, which were primarily equity-related investments starting at NOK 50 million and above. These investments were made both directly and in partnership with other organisations, with either Ferd Capital’s partner or Ferd Capital itself having the role of monitoring the investment.

Elopak

Elopak is a supplier of packaging systems for liquid food products. The company is a total system supplier, developing carton packaging solutions for both fresh and aseptic products. Elopak’s business is in general less cyclical than many other industries, and should therefore not experience any major loss of volume as a result of changes in economic conditions. However, the company expects carton sales for the juice market to be more volatile. Demand for these products is affected both by the state of consumers’ finances and changing preferences between juices and competing beverages.

Elopak’s total revenue in 2016 was NOK 8,202 million as compared to NOK 7,548 million in 2015. The increase in reported revenue was principally due to higher carton sales, particularly in roll-fed aseptic cartons. In euro terms, Elopak’s revenue was EUR 872 million as compared to EUR 856 million in 2015. Elopak reported EBITDA of NOK 702 million in 2016 as compared to NOK 608 million in 2015, while in euro terms this increase in earnings was EUR 7 million. The increase was due to higher carton volumes, but at the same time it was reduced by restructuring activities and non-recurring costs.

Good volume growth was achieved in both Europe and North America in 2016. Elopak continued with the deployment of its new fully aseptic filling machinery. Customer demand for this system is increasing as it becomes better known in the market. In North America, production in Montreal moved to Elopak’s new production facility, and the company is now in a period of strong volume growth in the North American market.

Aibel

Aibel is a supplier of services related to oil, gas and renewable energy. The company is one of the largest Norwegian service companies involved in engineering design, construction, maintenance and modification of oil and gas production facilities for the upstream oil and gas industry.

Aibel’s EBITDA was NOK 173 million in 2016, representing a decrease of NOK 218 million from 2015. The oil services market was challenging in 2016, with the price of oil dropping sharply at the start of the year. The whole industry has been through a period of cost cutting, capacity adjustments, and work to increase productivity.

At the end of 2016 Aibel was awarded four large contracts that together represent total contract value of over NOK 5 billion, including options. In February 2015, the company won the contract to build the platform deck for the Johan Sverdrup Drilling Platform, a project whose total estimated contract value now stands at NOK 10 billion. The contract resulted in a high level of activity in 2016, which will continue until delivery in the middle of 2018.

Although Aibel anticipates that the market will continue to be challenging in 2017, over the slightly longer term it expects the market to improve. The ageing stock of platforms on the Norwegian continental shelf means the need for maintenance is expected to increase.

Interwell

Interwell is a leading Norwegian supplier of high-technology well solutions for the international oil and gas industry. Its most important market is the Norwegian continental shelf. In recent years, Interwell has also expanded its presence in a number of important international markets such as the UK, the Middle East and the USA. Interwell delivered a satisfactory performance in 2016 in view of the challenging market conditions facing the industry. Interwell reported revenue of NOK 731 million in 2016, a decrease of 9% from 2015. EBITDA for 2016 was NOK 172 million, as compared to NOK 207 million in 2015.

The decrease in the price of oil and the cash flow situation at oil companies have created uncertainty for oil service companies. Despite this, Interwell is well positioned to achieve further growth, and historically the well intervention market has been less influenced by the cyclicality of the oil services market. In 2016 Interwell took new steps in the development and commercialisation of a permanent plugging solution for wells, including carrying out pilot testing.

In 2016 Interwell took new steps in the development and commercialisation of a permanent plugging solution for wells, including carrying out pilot testing.

Mestergruppen

Mestergruppen is a leading supplier of building products, primarily to the B2B market. Mestergruppen acquired two member-owned chains in 2016. In May, it bought Byggtorget, a building materials chain, and then in November it acquired Nordek, which comprises the XL-Bygg building materials chain and the Blink Hus house builder chain. Both companies’ shareholders received a combination of cash and shares in Mestergruppen as consideration for their shares.

Mestergruppen acquired two member-owned chains in 2016.

Pro forma adjusted revenue for Mestergruppen (including Byggtorget and Nordek) was NOK 6,290 million in 2016. 2015 building materials revenue at Mestergruppen as it was prior to these acquisitions was NOK 2,700 million. The company encountered challenging market conditions in south-western Norway and central Norway in 2016, but grew well or performed in line with 2015 in Norway’s other regions.

In 2017 Mestergruppen is working on achieving profitable growth by increasing volumes, improving its operational efficiency and realising synergies following the acquisitions it made in 2016.

Swix Sport

Swix Sport develops, manufactures and markets products for sporting and other recreational pursuits, both in Norway and internationally.

Revenue increased from NOK 918 million in 2015 to NOK 971 million in 2016, with approximately 51% of Swix Sport’s revenue generated outside Norway. This 6% increase in revenue is the result of the company’s acquisition of Hard Rocx, a cycle manufacturer, at the end of 2015 and of strong organic growth from its Lundhags and Ulvang brands. Swix Sport reported EBITDA of NOK 81 million in 2016 as compared to NOK 36 million in 2015. This increase is due to higher revenue and significantly lower operating expenses.

One of Swix’s objectives is to reduce the seasonal variation in its revenue, and it is pursuing this by focusing to a greater extent on the outdoor segment via the Lundhags and Ulvang brands and on the cycle segment via its acquisition of Hard Rocx.

Servi Group

Servi develops and manufactures customer-specific hydraulic systems, cylinders and valves for offshore, maritime and land-based industries.

Servi Group reported revenue of NOK 563 million in 2016 as compared to NOK 796 million in 2015. The company experienced difficult market conditions in the offshore segment. Due to its reduced order intake and profitability, Servi had to reduce its workforce by a further 50 employees, following a reduction of approximately 100 in 2015. Its workforce has decreased from around 400 in 2014 to around 250 at the end of 2016. EBITDA for 2016 was NOK -29 million, compared to NOK -3 million in 2015.

Servi expects the market to continue to be challenging in 2017, with downward pressure on prices from customers. Although the level of activity in the offshore segment is expected to remain low, Servi is experiencing a solid inflow of orders from land-based industries.

Fjord Line

Fjord Line is a modern shipping company that offers safe and environmentally friendly sea transportation between Norway, Denmark and Sweden.

Revenue increased from NOK 903 million in 2015 to NOK 1,161 million in 2016. The number of passenger journeys was up 10% in 2016, with the Sandefjord-Strømstad route in particular contributing to passenger growth, with new sailing times introduced on 1 October 2015. Fjord Line took over the tax-free shopping operations on all its ships in 2016. Increased revenue and significantly lower operating expenses as a result of efficiency measures and lower gas prices helped Fjord Line generate EBITDA of NOK 197 million in 2016, as compared to NOK 36 million in 2015.

The market for the company’s products is expected to be relatively stable in 2017. Fjord Line has a new and modern fleet. As customers are becoming more aware of the company’s routes and the service provided on board continues to improve, the company expects further passenger and revenue growth.

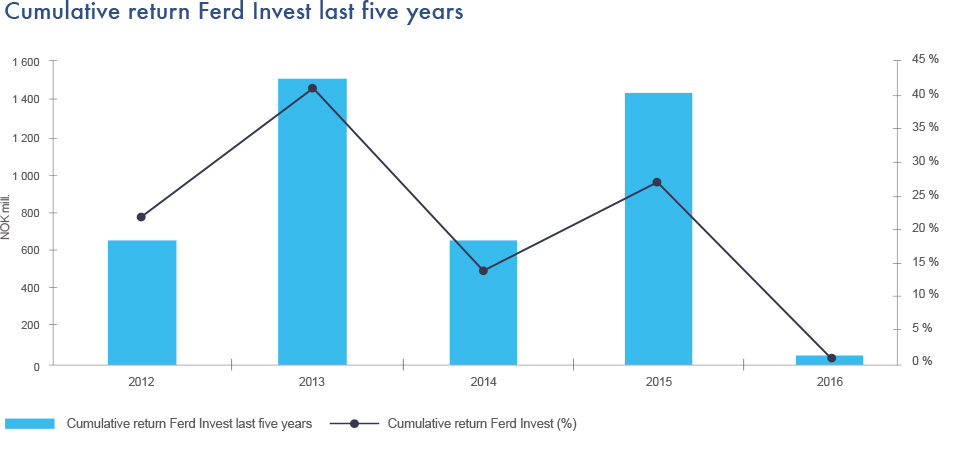

Ferd Invest

Ferd Invest invests in listed Nordic companies. Its target is to generate a return that is higher than the return on its Nordic benchmark index. Ferd Invest’s mandate does not stipulate limits with regard to the allocation of investments between countries or sectors and the portfolio differs significantly in its composition from the benchmark index.

Ferd Invest’s operating result was a loss of NOK 12 million in 2016 as compared to an operating profit of NOK 1,410 million in 2015. Most Nordic stock markets delivered positive returns in 2016.

In contrast to 2015 and 2014, the Danish stock market was the worst performing stock market in the Nordic region in 2016, falling 11% in DKK terms over the year. In local currency terms, the Finnish market was up 8%, the Oslo market was up 12%, and the Swedish market was up 9%. The performance of the Nordic stock markets in 2016 was lower when measured in Norwegian krone terms as a result of the Norwegian krone strengthening. Ferd Invest’s benchmark index was up 3.3% in NOK terms.

Ferd Invest’s portfolio generated a return of 0.6% in 2016, which is 2.7 percentage points weaker than the benchmark index. The business area’s most successful investments were Stora Enso, Skandiabanken and Marine Harvest. The business area’s least successful investment was Novo Nordisk.

At the close of 2016, the market value of the Ferd Invest portfolio was NOK 5.3 billion. NOK 1 billion was allocated out of the Invest portfolio in 2016. This capital was reallocated to other investments. The largest investments at the end of 2016 were Autoliv, HM, Norwegian and Stora Enso.

Ferd Hedge Fund

Ferd’s objective for its hedge fund portfolio is to achieve a good risk-adjusted return over time, both relative to the market and in absolute terms. In order to achieve good risk diversification, it is important that the composition of the portfolio features a range of funds which generate returns that are not dependent on the same risk factors.

Ferd Hedge Fund’s portfolio ended 2016 down 1.5% in USD terms, which was 3.4 percentage points below the benchmark index against which its performance is measured. At the close of 2016, the market value of the Ferd Hedge Fund portfolio was NOK 3.4 billion.

Ferd Hedge Fund made investments totalling USD 72 million in 2016. At the end of 2016, the five largest and ten largest positions represented 43% and 71% of the portfolio’s capital respectively.

Two investments have been made in the business area’s other mandate, Global Fund Opportunities. One of the funds invests in unlisted companies that are seeking to list within a few years. The other fund principally takes over distressed loans from banks in Asia. The market value of this portfolio at 31 December 2016 was NOK 362 million, a slight decrease from the end of 2015.

In 2016 Ferd Hedge Fund’s operating result for the year was a loss of NOK 73 million as compared to a profit of NOK 133 million in 2015.

Ferd Real Estate

Ferd Real Estate is an active real estate investor that principally works in real estate development. Its most important segments are residential real estate and office premises.

2016 was a very good year for Ferd Real Estate. Demand for centrally located commercial property was high, and the residential market was strong, particularly in Oslo. The business area reported an operating profit for 2016 of NOK 656 million as compared to NOK 316 million in 2015. Its value-adjusted equity at the end of 2016 was NOK 3.0 billion. The portfolio generated a return of 35% in 2016.

There are several reasons for the strong profit reported by Ferd Real Estate in 2016. Ferd Real Estate sold a property in Lysaker that is rented to the oil company Lundin for more than its previous valuation. The very strong return on the business area’s residential investments was due both to project gains and higher valuations on residential plots. A number of milestones were achieved on Ferd’s projects, for example a high proportion of residential units selling when a new sales phase was launched.

Ferd Real Estate’s largest residential project is Tiedemannsbyen in Oslo’s Ensjø district. The Tiedemannsbyen project is for around 1,400 units and will be carried out over a total period of between 10 and 15 years. Tiedemannsbyen DA, which is a collaboration between Skanska Bolig and Ferd, is developing the first 660 units or so, nearly all of which have now been sold. Tiedemannsfabrikken AS, which is owned 50/50 by Ferd Real Estate and Selvaag Bolig, is developing the next 350 units. The remainder of the project is owned by Ferd Real Estate. In total 383 residential units were sold in Tiedemannsbyen in 2016, compared to 115 in 2015.

Ferd Social Entrepreneurs

The criteria that social entrepreneurs have to meet in order for Ferd Social Entrepreneurs (FSE) to invest in them are that they must be able to demonstrate an innovative and scalable idea with a measurable impact. They must be focused on achieving a double bottom line, which is to say they must have a social impact and must also be or have the potential to be financially self-sustaining. It is taking time to establish a market for social entrepreneurs in Norway, and the market continues to be immature.

The Board of Ferd Holding AS has allocated NOK 25 million annually for work with social entrepreneurship. In addition, Ferd's other business areas and subsidiaries support social entrepreneurs with expertise, time and commitment as board members, and through other assistance.

Ferd Social Entrepreneurs had five companies in its portfolio at the end of 2016, and three companies transferred to the Alumni portfolio during the year. The Alumni portfolio consists of companies that have previously been FSE portfolio companies, and currently contains ten companies. FSE took an equity stake in a company for the first time in 2016. This investment consists of a 37.6% stake in Unicus that Ferd acquired when the company carried out a share issue, and the funds raised will be used to expand Unicus’ activities. FSE received and processed over 200 applications in 2016.

More information on FSE’s portfolio companies is available on the following webpage.

Social entrepreneurship is a strongly growing area internationally that is also attracting increasing interest in Norway. FSE is being approached by a large number of parties interested in the area who want to learn from FSE’s experience and to collaborate on potential projects.

Health, safety, environmental matters and employment equality

Recent years have seen an increasing emphasis on environmental issues in industrialised countries. None of the group’s activities produces discharges that require licensing and environmental monitoring, and the companies we own seek to operate in a sustainable manner and to demonstrate environmental awareness.

Elopak is continuing its commitment to environmental issues. An important milestone in this work was achieved in 2016 when the company became carbon-neutral. Elopak achieved this by reducing the emissions from its production and distribution activities and by investing in carbon-offsetting measures outside its value chain. Other companies in the group strive to limit their impact on the external environment to the greatest extent commercially possible, including by sorting waste and ensuring the proper disposal of specialist waste created by production processes.

The Ferd group had 3,549 employees at the end of 2016, and after including employees of Aibel the total number for 2016 was 7,600. The proportion of female employees was 23%. Sick leave amounted to 2.1% for the Ferd group in 2016. The working environment at Ferd AS is considered to be good. Ferd AS had 39 employees at the close of 2016. The Board of Directors of Ferd AS comprises one female director and four male directors. No serious accidents or injuries took place or were reported at Ferd AS in 2016. For the group as a whole, there were no accidents that led to loss of life, but there were individual cases of injuries at work that resulted in short periods of sick leave.

It is the company’s policy to treat female and male employees equally. This is reflected in a policy of equal salaries for equal responsibilities and a recruitment policy that emphasises the selection of candidates with the right expertise, experience and qualifications to meet the requirements of the position in question. The company strives to be an attractive employer for all employees, regardless of gender, disability, religion, lifestyle, ethnicity or national origin.

Allocation of profit for the year

It is proposed that the profit for the year of NOK 2,374 million is transferred to other equity.

Lysaker, 10 May 2017

The Board of Directors of Ferd AS